“What is HS Code?“, “What does it do?”, “What is the HTS Code for home furniture?” These issues are a piece of cake for an experienced importer or exporter. However, with the development of sites like alibaba.com, it is becoming easier and easier for us to sell our goods abroad or try to source the products we need from other countries. This also allows many friends who do not have any connection with import and export to enter the field of international trade, these problems become more and more common. At least from my perspective, it’s increasingly common for my new clients to ask. As a manufacturer of household furniture and with a lot of experience in exporting, I think it’s time to write this article to answer the questions of my new friends.

1. HS Code Overview

1.1 What is HS Code?

The Harmonized Commodity Description and Coding System (Harmonized Commodity Description and Coding System), also known as the Harmonized System of Tariff Nomenclature (HS), is an internationally standardized system of names and numbers for classifying traded products. It was formally implemented on January 1, 1988, revised every four years, and has since been developed and maintained by the World Customs Organization (WCO) (formerly the Customs Cooperation Council), an independent intergovernmental organization headquartered in Brussels, Belgium. More than 200 countries in the world already use the HS, and more than 98% of total global trade is classified in HS.

1.2 What does the HS Code Do?

HS Code Harmonization” covers the two major classification code systems of the Customs Cooperation Council Tariff Classification Catalogue (CCCN) and the United Nations Standard International Trade Classification (SITC), and is a systematic and multi-purpose international trade commodity classification system. In addition to customs tariff and trade statistics, it provides a set of international trade commodity classification systems that can be used for billing, statistics, computer data transmission, simplification of international trade documents and utilization of the Generalized System of Preferences (GSP) tariff codes for transportation commodities.

1.2.1 Tariffs

Tariffs are different for different customs codes, both for domestic and for customers’ imports.

1.2.2 Tax Refunds(Take China as an Example)

Customs code is different, the tax rebate rate will be different, although most of the paved products rebate rate is 13%, there is some special material products rebate rate maybe 5%, which is more than the difference between the loss, but also may be penalized.

1.2.3 Customs Declaration Elements

HS code is actually equivalent to the declaration of elements to do the specification, not standardized filling is easy to cause customs clearance failure, the need for secondary customs clearance, on the one hand, will affect the cost, on the other hand, will also affect the delivery time.

1.2.4 GSP(Generalized System of Preferences)

Some common GSP-compliant product categories also use HS codes as the basis.

1.2.5 Customs Data Statistics

This is more for the main regulators to facilitate regulation, but from another aspect, it is also really convenient for us to understand the overall situation of our industry.

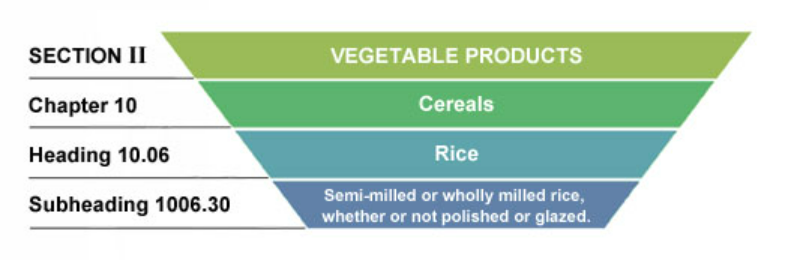

1.3 Content of HS Code

HS uses a six-digit code to divide all international trade goods into 22 categories and 98 chapters. The following chapters are further divided into items and subheadings. The first and second digits of the commodity code represent “Chapter”, the third and fourth digits represent “Heading”, and the fifth and sixth digits represent “Subheading”. The first 6 digits are the HS international standard code, HS has 1241 four-digit tariff items and 5113 six-digit subheadings. Some countries have divided the seventh, eighth and ninth digits according to the actual situation of their countries.

In HS, “Section” is basically divided by economic sectors, such as food, beverages and tobacco in Section IV, chemical industry and its related industrial products in the sixth, textile raw materials and products in the eleventh, mechanical and electrical equipment in the sixteenth category. HS “Chapter” classification basically takes two approaches: one is the classification of raw materials according to the properties of goods, and the same raw material products are generally grouped into the same chapter. Chapter according to the degree of processing of products from raw materials to finished products in order. Such as Chapter 52 cotton, according to the original cotton – has been carded cotton – cotton yarn – cotton cloth order. The second is the use or performance of goods by classification. Many products in the manufacturing industry are difficult to classify by their raw materials, especially products made of a variety of materials or products made of mixed materials (such as Chapter 64 shoes, Chapter 65 caps, Chapter 95 toys, etc.) and electrical and mechanical instrumentation products, etc. HS is divided into different chapters according to their function or use, without regard to what raw materials they use, and then the chapter is arranged by raw materials or processing procedures for the purpose or subheadings. The “bottom” role, is named “other” subheadings so that any import and export commodities can find their proper place in this classification system.

Since January 1, 1992, China’s import and export tariff code using the World Customs Organization “Harmonized Commodity Description and Coding System” (HS), the system is a scientific and systematic international trade commodity classification system, using a six-digit code, applicable to taxation, statistics, production, transportation, trade control, inspection and quarantine and other aspects, has become a standard language of international trade. China’s import and export tariff code uses ten-bit code, the first eight-bit equivalent using HS code, called the main code, the last two are our subheadings, called additional code, it is based on the HS classification principles and methods, according to the actual situation of China’s import and export commodities extended two codes.

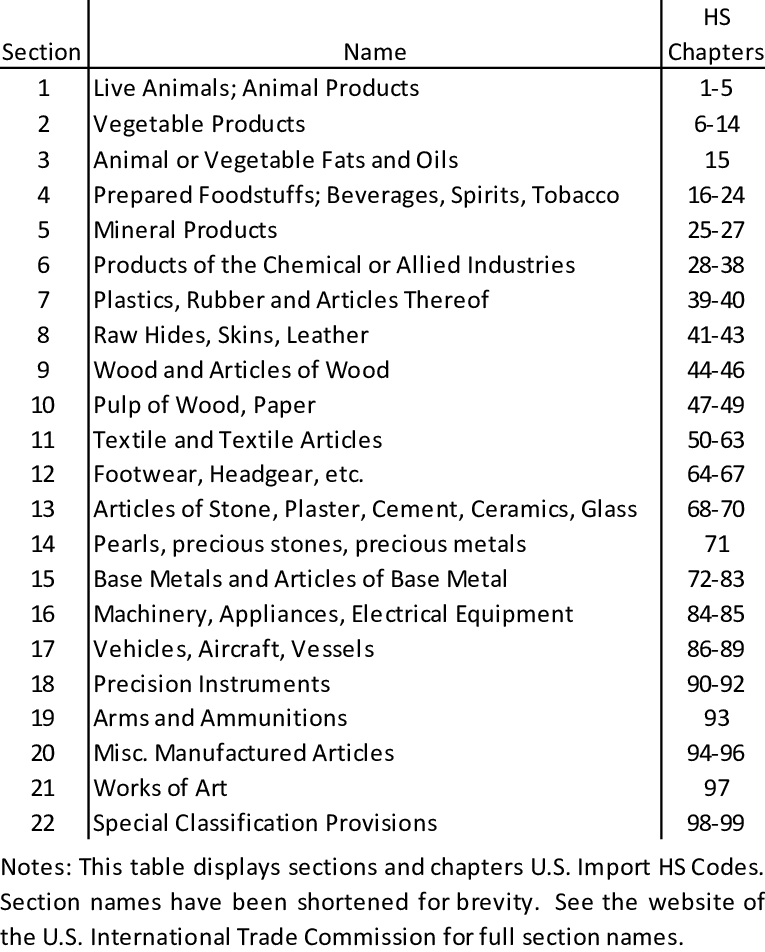

1.4 Product Catalog Table

The furniture belongs to Section 20th of Misc Manufactured Articles in Chapter 94, so the first two codes are 94.

2. The Most Commonly Used HS codes for Home Furniture (China and US Comparison)

We mentioned earlier that the furniture belongs to Chapter 94, but the specific 94 chapters include what specific content, we can break it down to see:

| HTS | Heading Description |

| 9401 | HS Code for Seats (other than those of heading 9402), whether or not convertible into beds, and parts. |

| 9402 | HS Code for Medical, surgical, dental or veterinary furniture (for example, operating tables, examination tables, hospital beds with mechanical fittings, dentists’ chairs); barbers’ chairs and similar chairs, having rotating as well as both reclining and elevating. |

| 9403 | HS Code for Other furniture and parts. |

| 9404 | HS Code for Mattress supports; articles of bedding and similar furnishing (for example, mattresses, quilts, eiderdowns, cushions, pouffes and pillows) fitted with springs or stuffed or internally fitted with any material or of cellular rubber or plastics. |

| 9405 | HS Code for Lamps and lighting fittings including searchlights and spotlights and parts thereof, not elsewhere specified or included; illuminated signs, illuminated nameplates and the like, having a permanently fixed light source, and parts of these goods not listed in other items. |

| 9406 | HS Code for Prefabricated buildings. |

We can see from the above, although 9404 will also involve some mattresses and other products can be counted as “furniture” category, but for the most part, in fact, our actual operation in more contact or 9401, 9402 and 9403. and because we are mainly to do the dining room furniture, therefore, the main contact is 9401 and 9403. We are mainly in contact with 9401 and 9403.

2.1 HTS Code: 9401

We can easily find sitting furniture is actually a separate large category, it can be understood that in addition to some special sitting furniture in the commercial field, most of the other sitting furniture is included in this Heading, the front section and Heading part of each country is almost the same, but this link is subdivided further down, each country will have some differences, here mainly in China and the United States for comparison.

2.1.1 China HS Code: 9401 List

| HS Code | Product Description |

| 9401 | HS Code for Seats (other than those of heading 9402), whether or not convertible into beds, and parts. |

| 94011000 | Seats for Aircraft |

| 94012010 | Leather or Recycled Leather Surface of Motor Vehicles with Seating |

| 94012090 | Other Seats for Motor Vehicles |

| 94013000 | Seats with Adjustable Height Rotating |

| 94014010 | Leather or Recycled Leather Surface Can Be Used for Bed Seating |

| 94014090 | Other Dual-Purpose Chairs that Can Be Used as Beds |

| 94015200 | Bamboo Seating |

| 94015300 | Rattan Seating |

| 94015900 | Wicker and Similar Materials Made of Seating |

| 94016110 | Leather or Recycled Leather Surface Cushioned Wooden Frame Seating |

| 94016190 | Other Cushioned Wooden Frames for Seating |

| 94016900 | Other Wood Framed Seating |

| 94017110 | Leather or Recycled Leather Surface with Upholstered Metal Seating |

| 94017190 | Other Upholstered Metal Frames Seating |

| 94017900 | Other Metal Frame Seating |

| 94018010 | Other Seating Made of Stone |

| 94018090 | Other Seatings |

| 94019011 | Seat Angle Adjuster for Motor Vehicles |

| 94019019 | Other Seating Parts for Motor Vehicles |

| 94019090 | Parts for Other Seatings |

As can be seen from the table above, the sitting furniture of various motor vehicles is also classified here, even including aircraft, and our indoor furniture manufacturers related to the HS code only the middle part, of which we will be involved only: 94013000, 94014010, 94015300, 94016110, 94016190, 94016900, 94017110, 94017190, 94017900, 94018090. The most commonly used are actually only two, distinguishing two different scenarios:

- Commercial Inspection Required: 94016900.90 Other Wood Framed Seating

- No Need for Commercial Inspection: 94017190.00 Other Wood Framed Seating

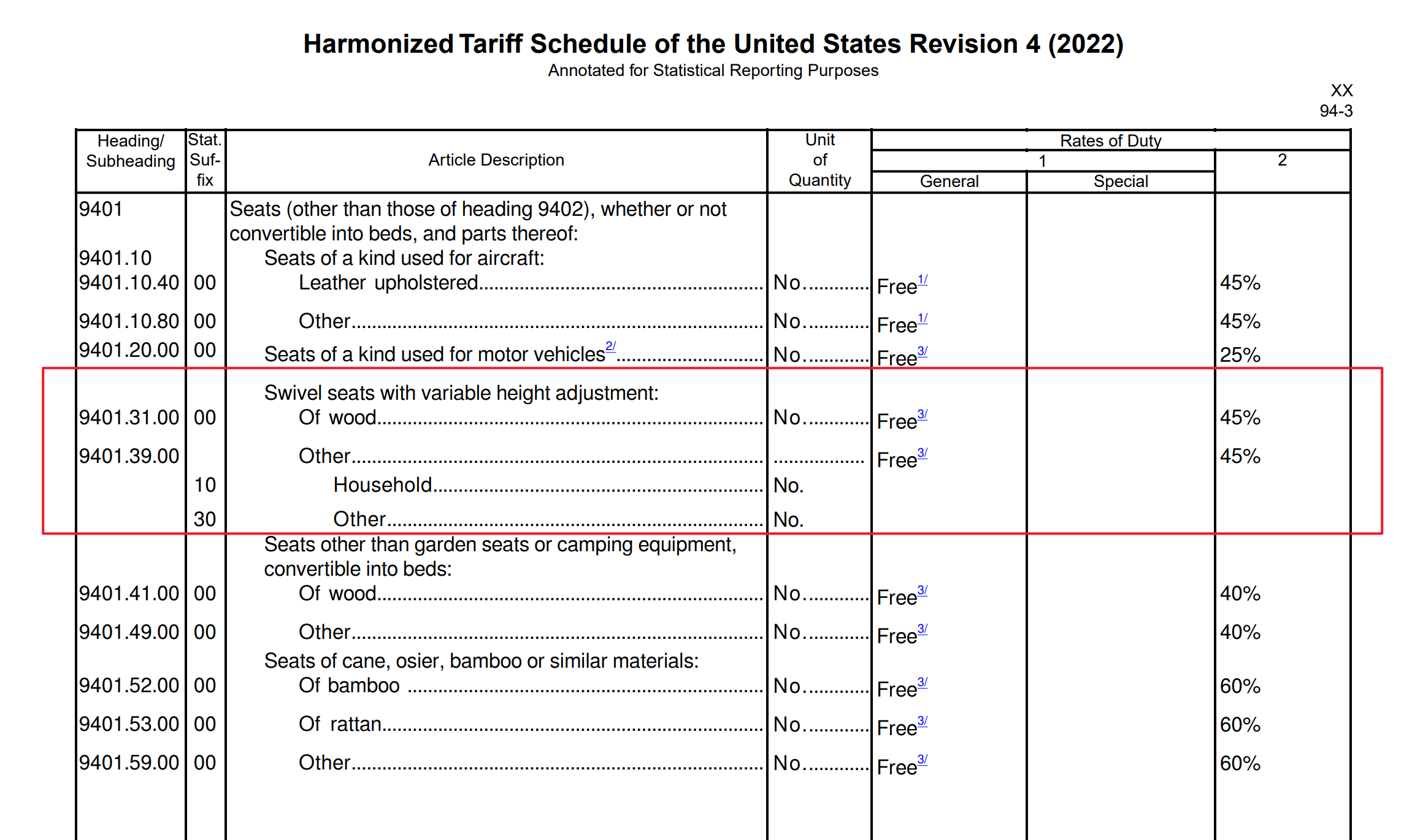

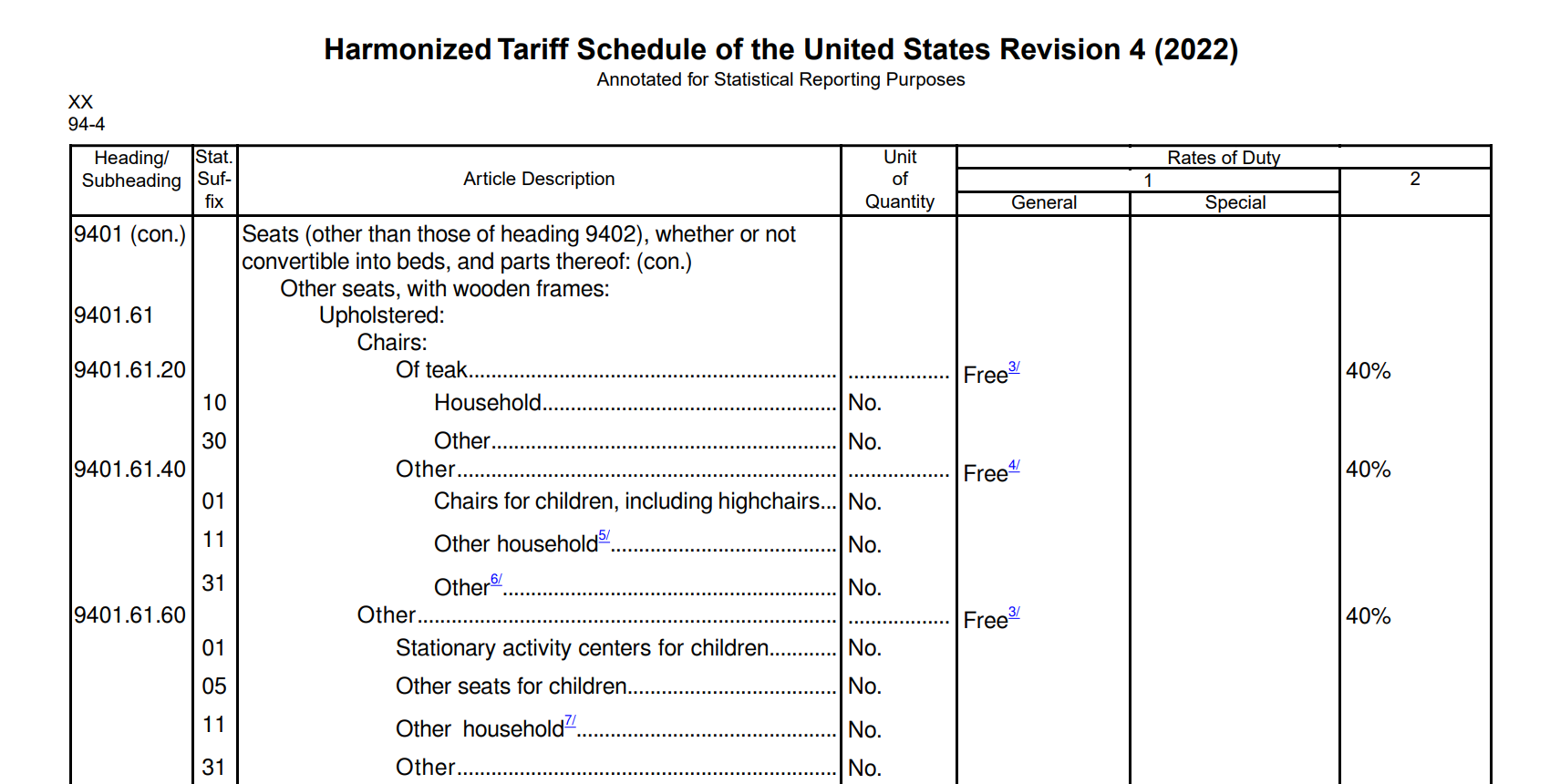

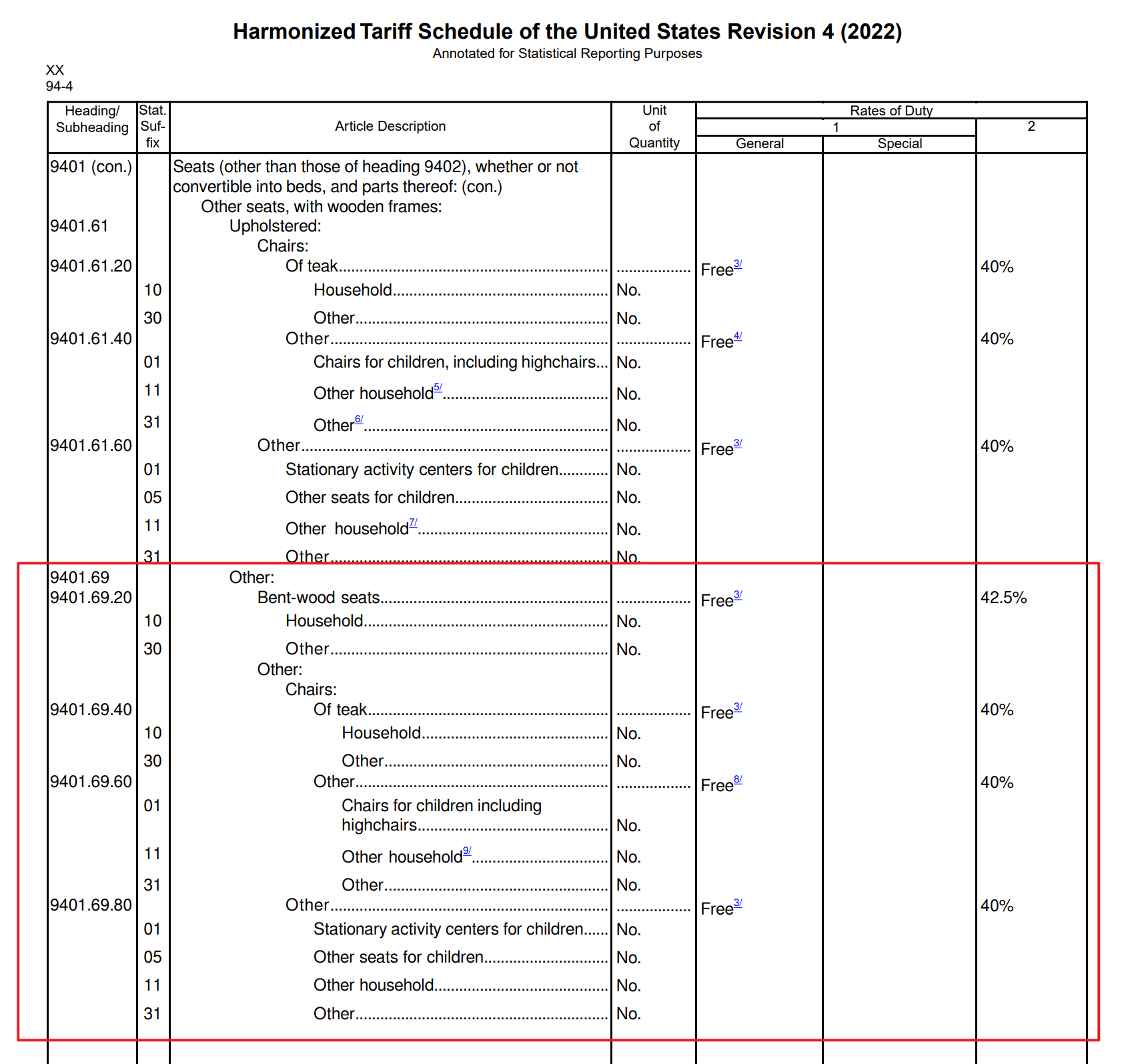

2.1.2 US HTS Code: 9401 List

| HTS Code | Product Description |

| 940110 | Seats of a Kind Used for Aircraft |

| 940130 | Swivel Seats with Variable Height Adjustment |

| 940161 | Other Seats, with Wooden Frames, Upholstered |

| 940169 | Other Seats, with Wooden Frames |

| 940180 | Other Seats, |

| 940190 | Parts |

It can be found that the HS code of the United States is relatively simple, which is relevant to us: 940130, 940161, 940169.

2.2 HTS Code: 9403

Compared to 9401 concentrated in sitting furniture, 9403 will be a little broader inside, we produce products that will be under this Heading mainly: dining tables, coffee tables and side tables.

2.2.1 China HS Code: 9403 List

| HS Code | Product Description |

| 94031000 | Metal Furniture for Office |

| 94032000 | Other Metal Furniture |

| 94033000 | Wooden Furniture for Office |

| 94034000 | Wooden Furniture for Kitchen |

| 94035010 | Bedroom Furniture Made of Mahogany |

| 94035091 | Natural Lacquered Wood Furniture for Bedroom |

| 94035099 | Other Wood Furniture for Bedroom |

| 96036010 | Other Mahogany Furniture |

| 96036091 | Other Natural Lacquered Wood Furniture |

| 96036099 | Other Wood Furniture |

| 94037000 | Plastic Furniture |

| 94038200 | Bamboo Furniture |

| 94038300 | Rattan Furniture |

| 94038910 | Wicker and Similar Materials for Furniture |

| 94038920 | Stone Furniture |

| 94038990 | Furniture of Other Materials |

| 94039000 | Parts for Items Listed in 9403 |

The mahogany furniture is definitely a Chinese characteristic of the classification, still, we are in daily use more contact with only two specific codes, the same, but also two application scenarios.

- Commercial Inspection Required: 94036099.90 Other Wood Furniture

- No Need for Commercial Inspection: 94032000.00 Other Metal Furniture

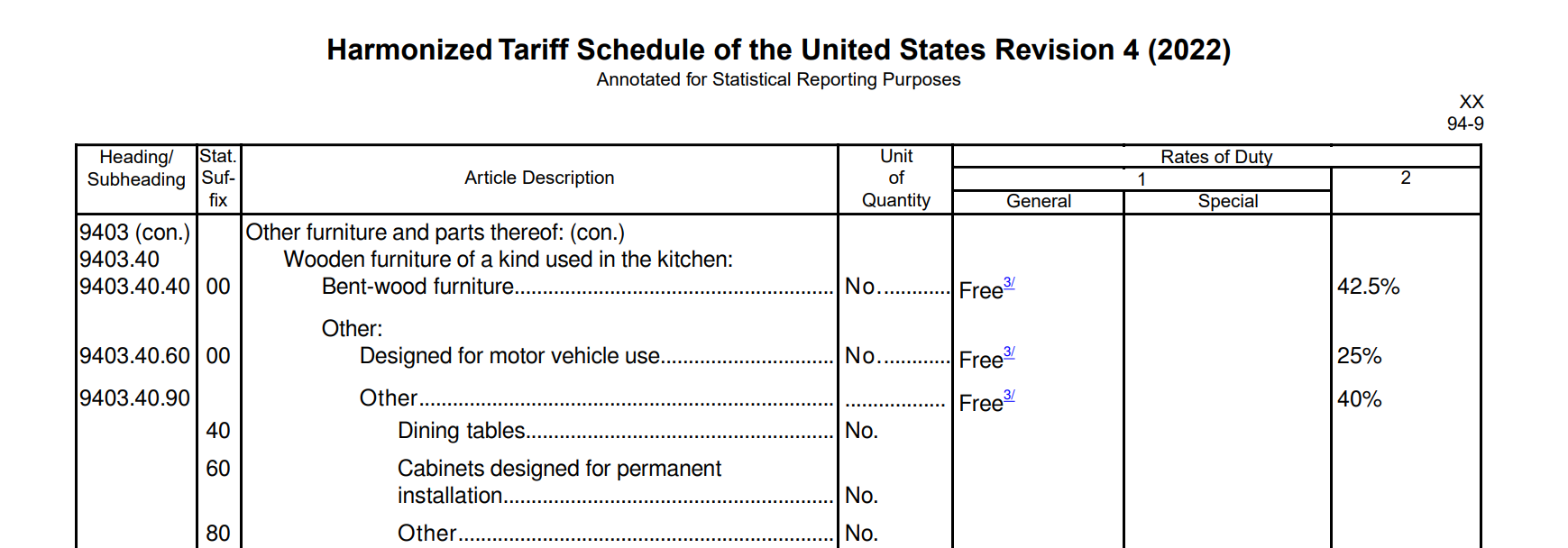

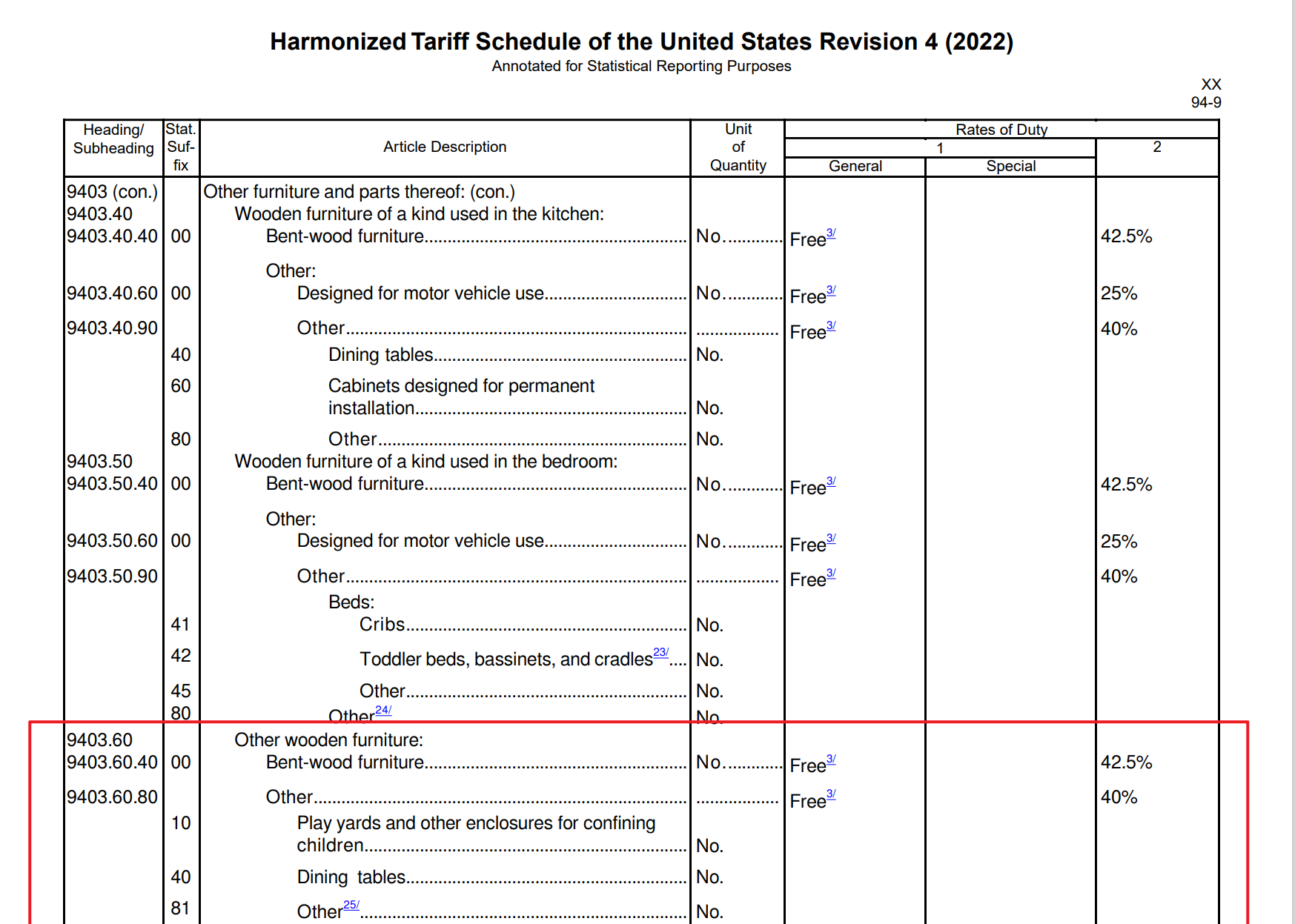

2.2.2 US HTS Code: 9403 List

| HTS Code | Product Description |

| 940310 | Metal Furniture of a kind Used in Offices |

| 940320 | Other Metal Furniture |

| 940330 | Wooden Furniture of a kind Used in Offices |

| 940340 | Wooden Furniture of a kind Used in Kitchen |

| 940350 | Wooden Furniture of a kind Used in Bedroom |

| 940360 | Other Wooden Furniture |

| 940370 | Furniture of Plastics |

| 940382 | Furniture of Other Materials, Including Cane, Osier, Bamboo Or Similar Materials of Bamboo |

| 940383 | Furniture of Rattan |

| 940389 | Other Furniture of Cane, Osier or Similar Materials |

| 940390 | Parts |

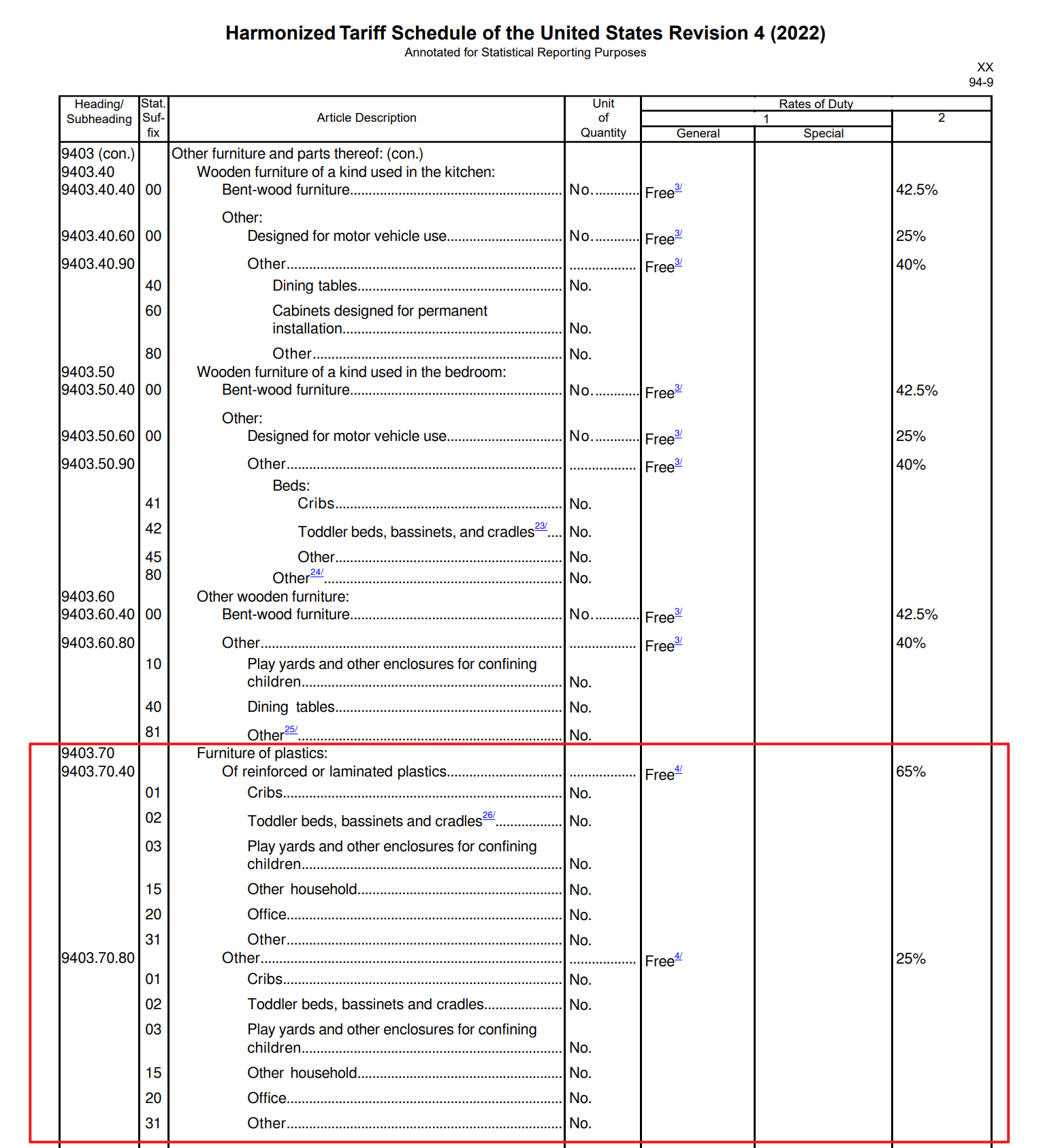

We are more exposed to the following: 940340, 940360 and 940370.

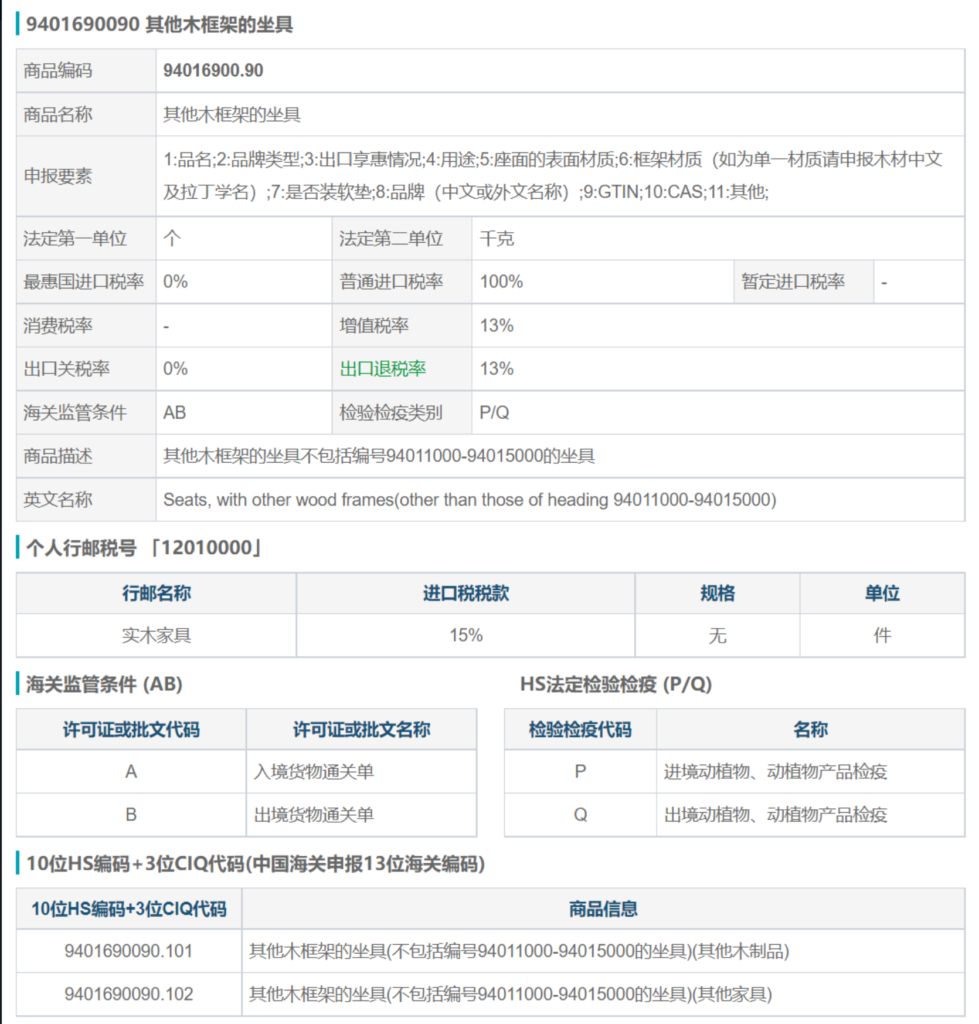

3. Application of Common HS Codes for Home Furniture (China)

In this part I just intercepted the corresponding information and did not provide the English translation, this is because this part is more suitable for Chinese exporters to use, for foreign friends is not applicable, if there are friends who want to understand this part, you can contact me directly to ask for the translation file.

3.1 94016900.90 Other Wood Framed Seating (Commercial Inspection Required)

3.2 94017190.00 Other Wood Framed Seating (No Need for Commercial Inspection)

3.3 94036099.90 Other Wood Furniture (Commercial Inspection Required)

3.4 94032000.00 Other Metal Furniture (No Need for Commercial Inspection)

4. Application of Common HTS Codes for Interior Furniture (USA)

First, the United States has a unified information website for relevant information: https://hts.usitc.gov/, you need to find the corresponding section to download the PDF file, and then check the latest policy in which the policy here will cover the following areas.

● Import tariffs in the United States for the corresponding product categories

● GSP preferences for the corresponding product categories

● Tariff rates for the corresponding product categories affected by China’s trade war

The Secretary of State’s website is available for search. (I am using the 2022 4th edition for the documents here, please check yourself for subsequent updates if any)

4.1 940130 Swivel Seats With Variable Height Adjustment

4.2 940161 Seats With Wooden Frames, Upholstered, Others

4.3 940169 Seats With Wooden Frames, Not Upholstered, Others

4.4 940340 Wooden Furniture (except Seats) Of A Kind Used In The Kitchen

4.5 940360 Wooden Furniture, Others

4.6 940370 Furniture Of Plastics, Others

Above, this is what I want to share with you about my sharing of the HS Code application in this field of furniture, whatever you have any questions about this, you can also feel free to ask me, I am always here. By the way, I am a professional manufacturer of living room furniture from China, if you want to purchase products in this category, feel free to contact me.